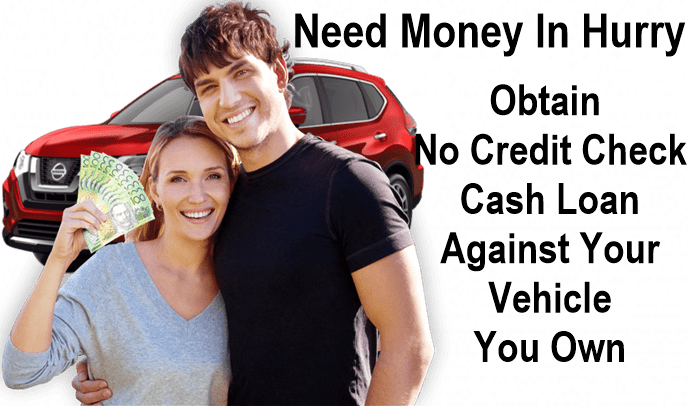

Cash Loans Against Cars

Use Car As Loan Security

- Pawn Your Car & Borrow Money

- Against Your Car You Own

- No Background or Credit Check

- No Repayment Until Car Pick Up

- VISIT TODAY, No Approval Needed.

Need Money Today

Borrow Against Your Car

Researching how to borrow against your car title? Look No Further, Hock a Car 4 Cash has funds available immediately so you may pawn your car and obtain NO CREDIT CHECK LOAN against your car title or van, utility or truck in minutes.

Needing to Pawn My Car

Act Now – Get in Touch

- Learn More Call: 02 9630 9968

- SMS Asset Photos for appraisal

- Enquire Online for pre-loan.

Borrow Money Against Your Car,

SUV, Ute or Truck Here

Visit Sydney’s Best Car Pawn Shop! We have your money waiting. Whether you require a small $500 loan or $80,000 cash loan against your car title will be advanced based on using your car as collateral and not your credit rating.borrow money against your car

Hock a Car Loans

Hock your Car 4 Cash are not selective when it comes to vehicle make or type. We consider all Cars, SUVs, Vans and Trucks to have value. Furthermore, we also offer an alternative service allowing you to pawn your motorcycle or boat.

No Credit Check Loan Against Car

Benefits

- No monthly repayment necessary

- Repay when you redeem vehicle

- Pay no application or hidden Fee

- No background or credit checks.

Borrow Against Your Car

Prestige, Classic or Family

Whether you own a $5000 Camry, $150,000 Torana, $80,000 Ford Mustang or $200,000 Mercedes Benz. We will endeavour to ensure your experience with Hock a Car is private and confidential with a guarantee that you will obtain your money against your vehicle value in minutes. There’s never a problem only a solution when you pawn your car, SUV, van or truck and borrow money against your car here.

Cash Loan Against Auto Guide

Any concerns you may have to hocking your car and obtaining a cash loan against your car title, view our terms, faq’s or how it works guide.

Hock your Car for Cash your Car Pawnbroker Loans Sydney Specialist, a family-owned loan shop with more than 30 years of combined industry experience. We are affiliated with Cash Fast Loans and Pawn a Car and our business is located in Sydney at North Parramatta. View about us

Don’t Wait!

Your Money is Waiting

Frequently Asked Questions

View to Learn More

What if my car is still on finance?

Should you have a car loan still outstanding, get in touch with us! We have a solution.

Can I get a pawn loan if I have a bad credit standing?

Your bad credit standing won’t be a hindrance.

02 9630 9968

02 9630 9968